How’s your mindset around credit cards? Most people have a consumer mindset around credit cards – they have negative idea’s engrained into their subconscious from years of conditioning. Problem is they don’t know how to use them and even fear them (at times these folks even experience paranoia like cutting them up frantically). Folks the problem is not the cards its the user!! Just like anything else, like being a skilled surfer making it look smooth and easy, the right information & skills applied responsibly and correctly, like knowing how to take advantage of the best airline credit cards, can to help you travel and surf more.

Tradition tells us “credit cards are bad,” the truth is credit is a tool of the wealthy. They simply know how to use it to their benefit and accelerate the wealth building process, they just have a different education and mindset on credit – they don’t fear credit they embrace credit and use it intelligently. Getting wealthy is one way to ensure you can live an Endless Summer and travel & surf on your terms, but unfortunately, the reality is that won’t happen quickly, but we will help you get wealthy quickly in airline currency aka Airline Milage – which is just as good as real money for flights.

When we build up a significant “bank” of airline mile we can take extended surf vacations or even mini-retirements. Keep reading, we will show you how to leverage the best airline credit cards to get your bank of miles up to 100k – that should be enough to get you excited and started.

Best Airline Credit Cards For People Who Travel and Surf

There is no shortage of credit cards “airline” or “milage” programs to entice you for your business. There is a bounty of them because people find them desirable (usually for the “sign-up” bonus) and they simply work great. The good news for you is that this combination of availability and constant sign up bones makes accumulating wealth in miles fairly easy so that any kook with enough motivation to take their next surf trip without the heavy flight expense can do it.

Best Airline Credit Cards for the Surf Traveler

#1 Alaska Airlines and Delta AMEX

Sign Up Bonus: 25,000 Miles (Upon Approval)

Review: Alaska Airline has been becoming more popular along the west coast routes in recent years, including direct flights from the west coast to the Hawaiian Islands and Cabo San Lucas. It just makes sense to have one of these in your wallet for many reasons. Most airline cards have a spending requirement prior to awarding the bonus miles, this card does not. One of the most important feature of the Alaska Airlines credit card – does not really have to do anything with the card itself, it has to do with the Alaska’s generous surfboard bag policy, Alaska is one of the few remaining carriers that does NOT charge for most surfboard travel bags. So getting this card is simply a win-win, you get 25,000 miles after your approved, you have more incentive to take a surf trip with out a surfboard travel bag fee and are supporting an airline that is surf travel friendly. 25k To Start & No Surfboard Bag Fees? Seriously! If you don’t do it for your self, do it for someone else.

#1 Delta Skymiles AMEX

Sign Up Bonus: Typically 30,000. Current Promotion 50,000 (Good ONLY Through July, 6th 2016)

Your likely wondering why there are two #1 “Best Cards for People Who Travel and Surf” – no its not a mistake. The Delta Skymiles AMEX is a great card to add to your quiver because it is a partner of Alaska Airlines, meaning smart travelers that build a quick bank of miles by applying for both card and can use them for either airlines (that’s 75,000 between the two!). Unlike, the Alaska card the Delta Gold spending requirement is only $2000 in the first 3 months, which is relatively low and easy to get to – just put your food and gas on this for the 3 months. We really like the Delta option as a carrier as it can pretty much take you Round-the-World, literally…last year we booked a round-the-world flight with Delta 100% on miles using these techniques and the best part was it was Business Class, for more info see, Why I Fly Round-the-World Business Class (and Maybe You Should To).

Delta also has a referral program that helps boost your personal milage account while helping our your friends, typically it is an additional 5k per friend referred not to exceed 55k in a calendar year. At times the referral reward can be as high as 10k per person – as it is now – so hook up your friends!.This card also is set up no foreign transaction fees, one FREE checked bag and the annual fee is wavied for the first year. The Delta Gold Card – Its more like the Delta Emerald Barrel Card. For these reasons, and the SkyTeam partnership, it is tied for the #1 spot of “Best Airline Credit Cards For the Surf Traveler.”

#3 Chase Sapphire Preferred

Sign Up Bonus: 50,000

Becoming more popular are airline reward cards that don’t have a specific affiliation with one particular airline or hotel, like the Chase Sapphire Preferred. This provides any traveler with lots of flexibility to choose the “free flight” with multiple carrier options (or accommodation) and also the ability to “transfer” points to a specific reward program – boosting that account up. Another huge plus is that this card “zero foreign transaction fees” – so that buzz kill won’t happen with this card. The Sapphire card does come with a spending requirement of $4,000 in the first 3 months, has a $95 annual fee that is waived for your first year. How’s 50K more?

#4 Barclay Arrival Plus World Elite

Sign Up Bonus: 40,000

Just like the Chase Sapphire, the Barclay Arrival Plus card is one of the newer hybrid cards that provides flexibility and options to be used on any travel purchase. You’ll get $400 off your next surf trip. Just make a travel purchase with the card and use your points to offset all or part of the charge on your statement. This card earns double miles on ALL purchases, just like the Capital One Venture card you see on TV, but it’s better because you can use your points to offset just some or all of a charge – it’s your choice. During the introductory period a user will need to make $3,000 of purchases within the first 90 days to get the bonus – the really cool thing is that you can get up to 40 point per dollar spent when the requirement is met.

#5 American Airlines Citi AAdvantage

Sign Up Bonus: 25,000 – 50,000

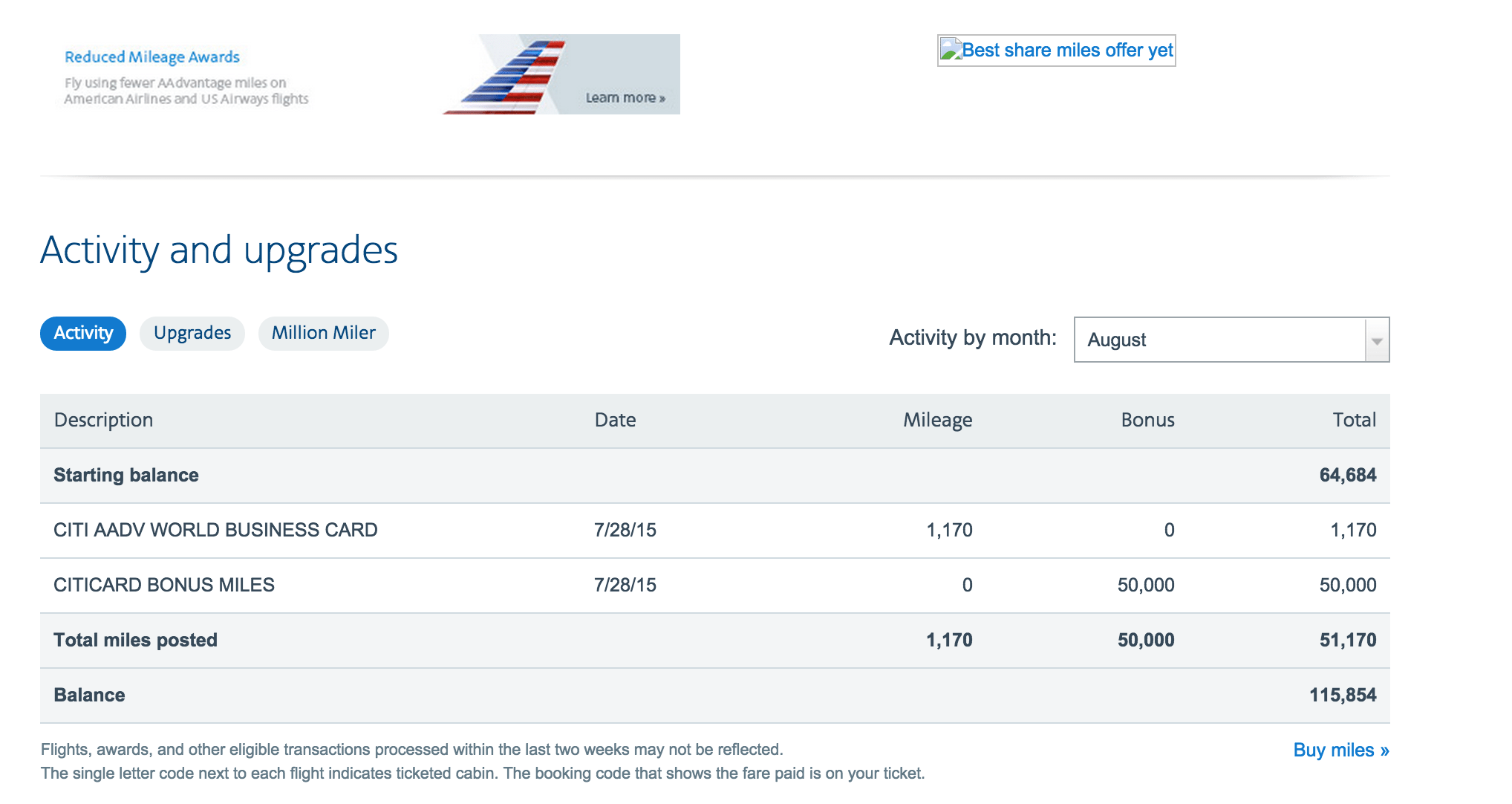

Review: The Citi American Airlines AAdvantage card options offer a ton of value for the the surf traveler. Like most cards you have to spend a certain dollar figure before you qualify for the bonus and most of these have some sort of an annual fee. In this case, depending on the card, spending requirement are for the 1st three months and are between $750 and up to $5,000. The cool thing about American is that you can practically get to any rad surf destination in the world between American Airlines and it’s partners. Personally, I carry 2 AAdvantage cards, one business and one personal, two times the fun. We were able to get the 50,000 bonus via the American Airlines Citi Business, just for a goof!

#7 United Milage Plus

Sign Up Bonus: 30,000

United partners with Chase Bank for their Mileage Plus Explorer Card. United, like Delta and American, is a large carrier with a vast partner network that can practically take you to any surf destination. Like the Delta card this one has a palatable entry spending requirement of only $1000 in the first 3 months and just like its sister card the Chase Sapphire – it has an explosive milage bonus of up to $30 per mile spend in the introductory period. The biggest reason to build a bank of miles with United is that they may be the only airline that still offers a specific Round-The-World award ticket. Delta and American ended their programs over the past couple of years – yet you can still book round-the-world on segments. With the #RTW ticket you can make several stops (up to 6 or 7) in one direction (east or west) – last time we checked it was in the 200,000 mile range for economy and in the 300,000 range for business class. Imagine that a surf trip around the world on miles? Its rad – we’ve done it with Delta as we’ve mentioned . Combining the MileagePlus Explorer Card with the Chase Sapphire an transferring the miles over to United will put you at over 80,000 just from taking advantage of these offers.

Additional Airline Mileage Credit Cards to Consider

As you can see nearly every major airline has either a directly affiliated card or part of a hybrid program – that is great news for serious surf travelers, it means we can travel and surf smarter and more. Be sure to check out the offers for Southwest, British Airways and LAN.

Too many options? This is just a short list of rad cards that make sense for people that want to travel and surf smarter, more and differently. Which one should you get? I can’t say which one is best for you personally, but if I were you I would try to get them all build my milage currency and at least have travel options.

Our disclaimer: We are never going to tell anyone what to do with their money or credit. All we can do is share personal and opinions of seasoned travelers strategies and tactics. We believe in responsible credit usage and if you have had problems managing credit in the past this may not be for you. If you do want to implement these proven tactics to surf more but can’t seem to get approved consider Credit Karma – an online resource with actionable info to improve anyones credit scenario and “subscribe” below to our email list where we cover strategies that don’t require credit. Building and increasing your credit score won’t be easy but it will be worth it, there are plenty of head high, warm water point breaks that you can get to for free on miles.

How to Build a Bank of 100,000 Airline Miles in 6 Months

You don’t need to be a genius to build a bank of airline currency, you need to execute and take action. The one rule with all of this is that this only works if you work it.

The idea is simple, what you want to do is pick a 2 to 3 offers at first and apply for them, lets say the Chase Sapphire and Delta Gold Amex for example. After 3 months, assuming you meet the spending requirements, you will have 50,000 Sapphire and 30,000 (plus and spending and accruing miles from purchases). You can even get 100 pounds loan.

Next, after the first 90 day period, you apply again for another 2 to 3 of the best airline credit cards. Lets say this time you took advantage of the Barclay Arrival card and the United Mileage Plus card. After this new 90 day introductory period is satisfied you will have now 40,000 miles from Barclays and another 30,000 from United – and you will be well on your way to hundreds of thousands of airline miles that you can use for your own surf trips, for friend & family travel or simply to donate for goodwill. It may not make you wealthy in dollars, but it will make you wealthy in miles, memories and experiences.