Summary of How to Build Wealth with Vacation Rental Homes

- In this post & video, learn the smart way to add vacation rentals as part of your wealth building plan

- We expose our Principles & Strategy to build wealth via vacation home rentals in real estate in 5 simple steps

- We’ll show you by graph how wealth is built. When you can see it becomes easier to understand

- Learn Warren Buffett’s 2 Rules of Investing & why its so important to learn how to “buy right”

Rad News & Opportunities!

- Updated & New Content: Vacation Rental Dojo, Mike & Maria’s Free online vacation rental learning center. PLUS Our Vacation Rental Business Plan in a Box!

- Vacation Rental Confidential, Our Book: VRC is a quick showcase of the Live Swell Story & Proven Biz Model Download Chapters 1 & 2 Free, Our Gift to You

- Exclusive NEW Release: Live Swell’s Sparkling Clean Training & Certification Program

A lot of people are interested in building wealth though real estate investments. Interestingly, not many people think of vacation rental investment(s) as a component of their real estate wealth building plan. Too bad for them, but good for you! It can be done and can be a lot more fun.

In this article we will focus on how to build wealth with vacation rental homes. This should help you feel more confident with real estate investing financial principles so you can make better and wise investment decisions.

How to Build Wealth with Rental Property In 5 Simple Steps

Principles & Strategy:

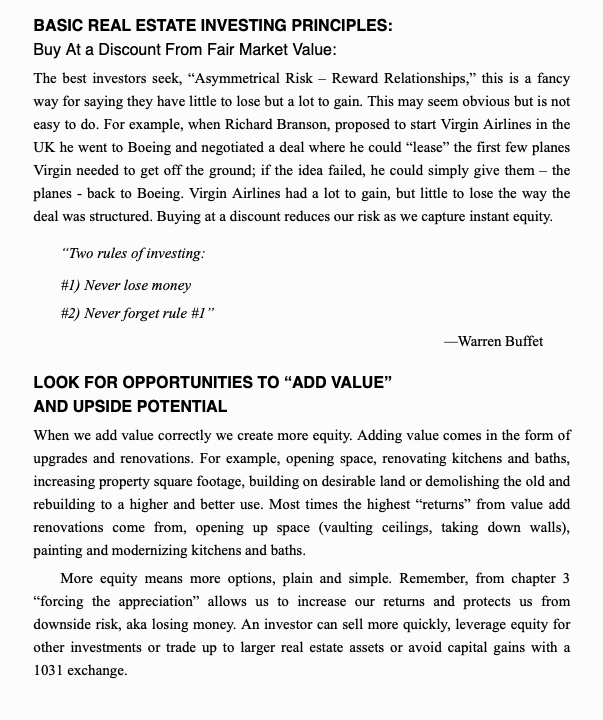

- Buy at a discount from fair market value

- Debt, used wisely, is an accelerator of wealth

- Look for opportunities to significantly increase & add value

- Develop a system to generate cash flow from these assets

- Repeat this process over and over

What does building wealth with vacation rentals look like?

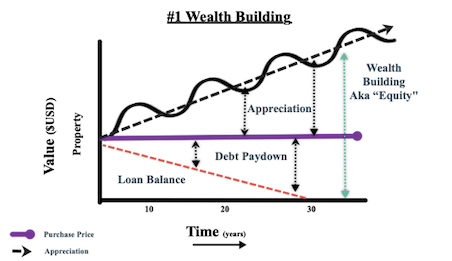

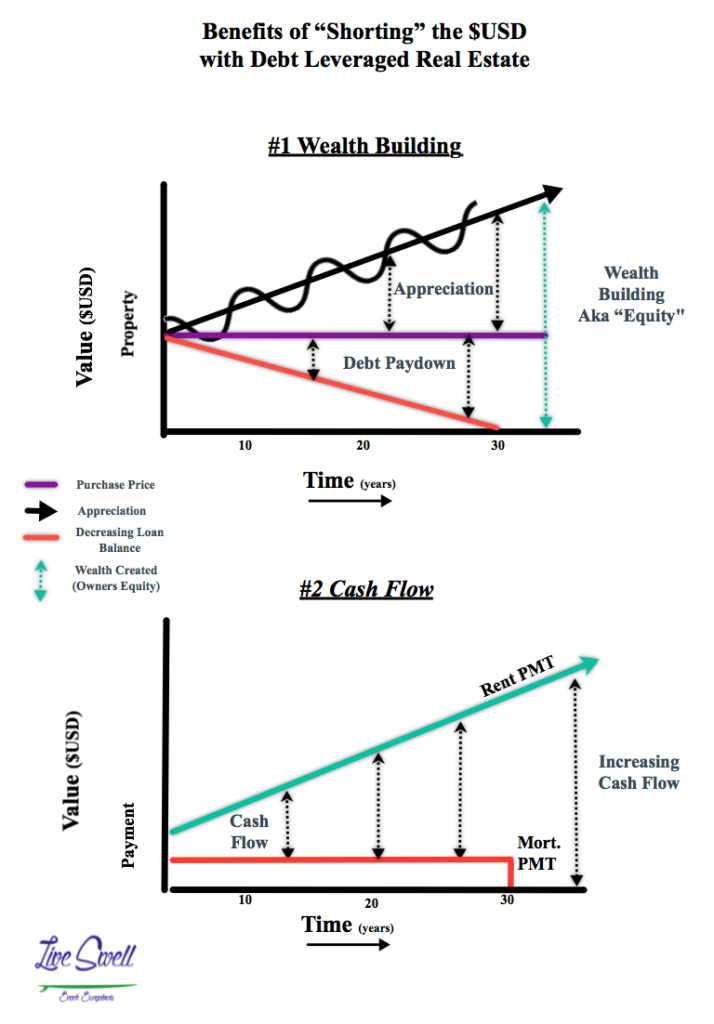

I created these graphs below to help make sense of the real estate wealth building process over time.

In Graph #1 Wealth Building, try to observe “Year 0” though “Year 30” to see visually how wealth is built. Owners “Equity” is shown as the gap between the black line, property value, and the red line, any remaining loan balance.

Similarly, In Graph #2 Cash Flow, again observe “Year 0” though “Year 30” to see how cash flows increase over time with a fixed loan payment. Taking advantage of debt allows us to short the dollar, a high level financial concept. To learn more see: How to Short The Dollar with Vacation Rentals

Wealth Building With Vacation Rental Homes Explained:

How NOT to Build Wealth with Vacation Rental Homes?

Its important to realize that most business are not easy. The principles presented here are to show, “how to build wealth,” with vacation rentals. The reality is that not every vacation rental investment will result in wealth building.

You may be asking, “Why?” Well, there are many factors solely in the control of the investor-buyer that will impact how well or poorly an investment performs. These include factors like, purchase price, improvement management and operation of the rental program side of the business to name just a few.

For example, if a person overpays for the vacation home, gets ripped off by contractors during improvements and simply does not drive high income though rental operations, that likely won’t be a stunning wealth builder. On the other hand, if the wise investor-buyer locates properties a a discount from fair market value, makes smart improvements that force property appreciation, drive lots of income in VR operations and get great reviews, I’ll bet that will be a great investment.

Real Estate Investing Principles Applied to Vacation Rental Wealth Building Explained:

Related Content

The “E” Myth Applied to Vacation Rental + Airbnb Hosts Business Model

Michael Hamilton’s 5 Keys to Succeed as an Airbnb and Vacation Rental Owner (Confidential)

To People That Want Freedom like a Beach Bum (Without Being Broke)